THE PRICE OF BUTTER

Butter! If your circles are anything like ours, a week won’t go by without butter prices coming up in conversation. This isn’t the first time the price of butter has made headlines - but why is it having such a moment right now?

The economic story is complex: New Zealand is the top global exporter of butter, and global demand for butter has increased in recent years, while New Zealand currency has weakened.

The other side of the story is human. New Zealanders love butter — but it’s also become the emblem of soaring grocery prices, a launching point for conversations about the cost of living.

A non-exhaustive collection of news articles about butter in New Zealand from the last 7 months.

In July 2025, this came to a head with Butter-gate: Finance minister Nicola Willis was called to answer for $11 blocks of butter after the government had run on a platform of reducing the cost of living.

The Spinoff noted the unusual news coverage generated by her meeting with Fonterra chief executive Miles Hurrell: “News sites ran red breaking news banners as Hurrell and Willis sat down to talk.”

We’ve all heard the question: “New Zealand makes butter! Why are we paying so much? And why is our butter more expensive here than it is overseas?” But how much do we really know about butter production, and the reason we pay the prices we do?

We had a few questions to answer:

Is New Zealand butter really that expensive?

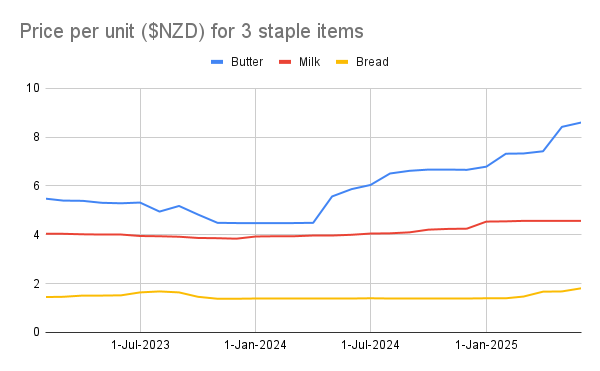

Meaning, does the price increase go beyond what’s expected, given inflation? As an indicative comparison, let’s look at butter alongside other grocery staples like milk and bread:

Unit price of 3 grocery items over 28 months

Percentage increase in price for the same 3 grocery items, over 28 months

The cost per unit of butter has risen dramatically more than the other 2 products - it actually increased by 56% between Feb 2023 - June 2025. In the same period the other two products remain fairly stable in price - both saw a small increase over the course of 2025, but nothing dramatic. So the answer is yes, it is getting more expensive, beyond what you would reasonably expect given inflation.

Why is it so expensive when we make it here?

To get into this, first we have to talk about how the butter industry works. 80% of New Zealand farmers sell milk to Fonterra (which operates in a co-op model, in that it’s owned by the participating farmers). There are smaller producers, independents - but at that scale, Fonterra sets the farmgate price of milk (the price farmers sell it for) in New Zealand. Fonterra then processes the milk into products - it owns brands like Anchor and Meadowfresh - and then it sells 95% of those products on the global market. This means global supply and demand sets the price.

This is one part of the answer.

(NB: It’s worth noting that a few factors can influence the farmgate price of milk, including typical seasonal fluctuations in weather and yield. I couldn’t find any compelling evidence that this was linked to the meteoric rise in prices we’re talking about here.)

Exposure to global markets

New Zealand is consistently one of the biggest butter exporters in the world, with 23% of the market share. New Zealand exports 95% of all its dairy products, including butter, meaning the international market sets our price in New Zealand.

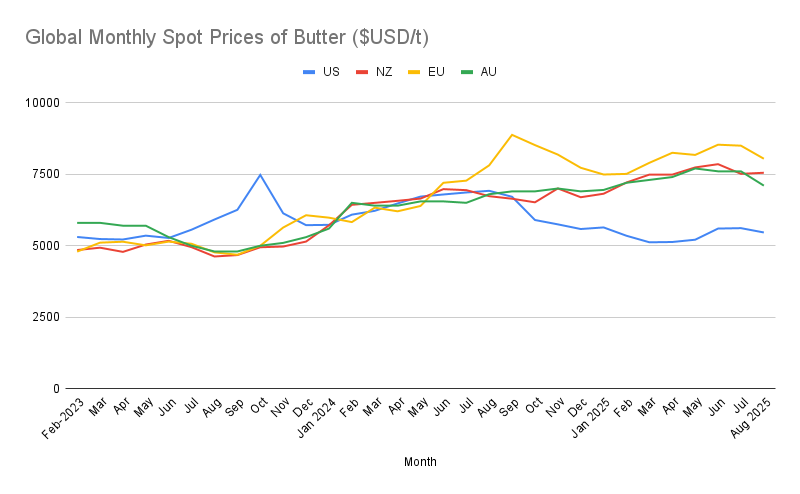

(NB: New Zealand is the biggest producer of butter in the world per capita, making 98kg of butter per person, as well as the biggest consumers of butter in the world per capita.)The international market: Global Monthly Spot Prices of Butter in $USD per tonne.

How does this actually work? Fonterra lists its milk products, including butter, on the Global Dairy Trade (GDT) platform where bidding takes place twice a month - so the price is set by supply and demand at that time. GDT was created by Fonterra, and about USD$2-3 Billion of global butter trade flows through that platform per year (total annual trade is ~USD$40B).

In recent years, global demand has also increased in regions like South America, China, and the Middle East due to higher income levels, urbanisation and exposure to western food culture. Just last month (January 2026), RNZ reported that the price of butter on the Global Dairy Trade index jumped 3.8%, with the Middle East doubling their purchasing share.

While the global demand pushes up the price of New Zealand butter, the average New Zealander faces a few challenges to their buying power at home.

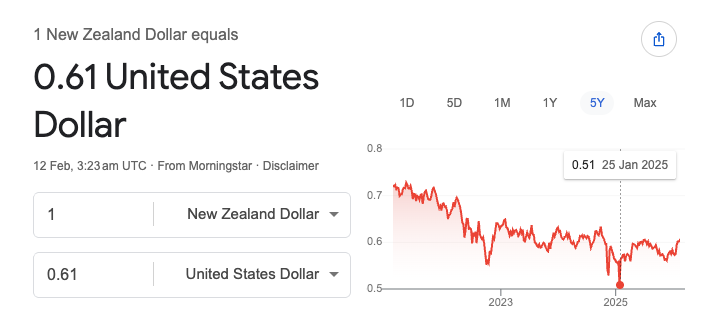

The fate of the NZD.

Over the last few years, there have been dips in the NZD - notably late in 2022 and late 2025, leading into this year - and wages in New Zealand have also remained stagnant, meaning New Zealanders feel the pinch at the checkout.

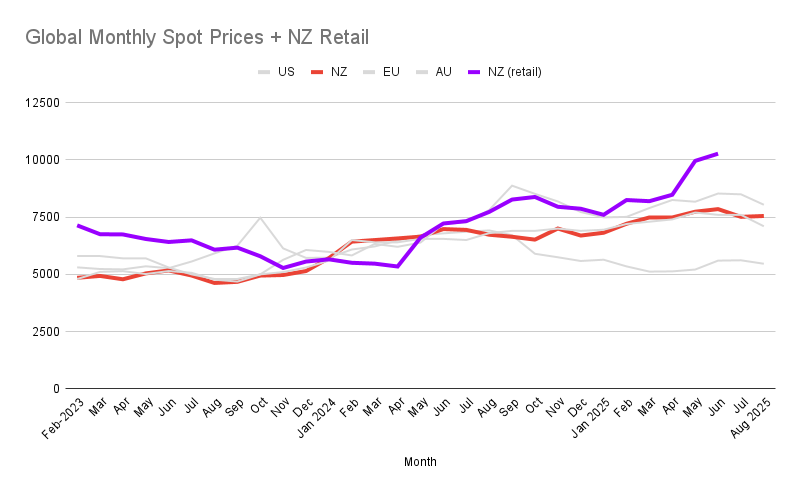

However, as of February 2026, global butter prices have fallen around 27% from their mid-year peak in May-June 2025. Meanwhile, prices in New Zealand supermarkets have barely shifted. Stats NZ data shows they’ve fallen by only 1.2% over the same period.

Global Monthly Spot Prices with NZ highlighted + NZ retail pricing (data has been standardised to USD / tonne).

Note that in the graph above, the New Zealand retail price of butter remains high and continues climbing in late 2025 - even after global spot prices stabilise across the board.

So what else is at play here?

The NZ supermarket duopoly:

Foodstuffs and Woolworths have long faced criticism for inflating prices, and opinions on their role in the price of butter is no different.

Both Foodstuffs and Woolworths lock in butter supply contracts on a quarterly basis, which could lead to a scenario where stores take longer to move stock that was purchased at a higher price. But data suggests there may be more to this.

In 2022, the Commerce Commission released a report that found a number of key issues with the supermarket industry:

A supermarket duopoly exists in New Zealand, with minimal competition

Grocery prices were high by international standards,

Profitability was higher than expected by New Zealand standards, and

Practices like land banking (buying land and holding it for future use without any specific plans for its development) create a high barrier to entry for prospective new competitors

Representatives from the dairy industry have also suggested that supermarkets are responsible for the price of butter being so high.

New Zealand’s unique challenges: geography and population

In their report, the Commerce Commission also noted that supply chain complexity added another layer of cost. In short: our low population density, coupled with being spread out across large geographic areas compared to other more dense countries, leads to inefficiencies and a higher cost of transport and distribution.

There’s also a lower economy of scale that goes hand in hand with having a smaller population.

So, what does this all mean?

Butter prices in New Zealand are clearly driven by global, rather than domestic, demand. That global demand is growing, and the high value of New Zealand butter overseas, coupled with a weakened New Zealand dollar and wage stagnation, means the average kiwi has less buying power. Other economic forces like lack of retail competition also feed into the high cost of butter.

What does this mean for butter-loving New Zealanders? Have people given it up, or will consumers keep paying high prices? We asked some New Zealanders what they’ll be doing:

“We get small amounts of high end butter and use it for special things where you taste it a lot. I have a baking brand I buy. I did sometimes use Lewis Rd to bake depending on how butter forward it was. But no more.” - Emma, Wellington

“Still eat butter. Appreciate it a lot. Makes me sad that baking becomes more expensive. If I have time I will stretch it with food oils, eg. Mix in avocado, olive and flaxseed oil. Adds more healthy fats and makes it spreadable.” — Anja, Christchurch

“Yes it’s too expensive. Hacks are to buy proper butter for baking and use the butter/canola mixes for toast.” — Sharon, Christchurch

“Buy Costco butter and eat less of it. Make my own suet lard or tallow instead of using butter. Also use more sunflower seed oil.” — Johan, Auckland

“I bought fancy butter (Lewis Road) as a treat…but if I'm baking just whatever is cheap.” — Colette, Auckland

Two people said they stole (!) butter, and the most promising response was from Emily in Wellington:

“[A few of us] are building an app so we can compare prices across supermarkets and buy the cheapest item from each supermarket. It means going to multiple stores but it is cheaper!”

We love to see an innovator.

What about you? Have you been impacted by the increase in butter prices? Would you try making your own? What would you be interested in reading about next?

A note on the data here: Stats NZ data shows that the price of butter started to fall at the end of 2025. However, Infometrics Chief Executive Brad Olsen notes that the price won’t fall nearly as fast, or by as much as it rose. Indeed, the latest market update indicates that prices are rising again.

Finally, I’m not a data scientist, just interested in answering questions (if you are and you’re also interested in this, please get in touch!)

SOURCES:

https://oec.world/en/profile/bilateral-product/butter/reporter/nzl

https://www.fonterra.com/nz/en/our-stories/articles/whats-driving-new-zealand-butter-prices.html

https://www.fortunebusinessinsights.com/butter-market-106457

https://www.researchandmarkets.com/report/middle-east-butter-market

https://www.rnz.co.nz/news/business/583367/dairy-prices-reverse-course-with-demand-rising

https://itbrief.co.nz/story/new-zealand-jobs-rise-but-wages-hours-fall-amid-caution

https://newsroom.co.nz/2025/07/24/butter-saga-a-smear-on-supermarket-competition-and-social-licence/

https://www.farmersweekly.co.nz/markets/farmers-blame-supermarkets-over-butter-prices/

https://www.rnz.co.nz/news/country/580792/why-butter-prices-might-not-fall-as-fast-as-they-rose